FINRA Consolidates the Collection and Processing of Regulation T and SEC Rule 15c3-3 Extension of Time Requests

Systems Changes and Requirements for Extension of Time Requests

| Regulatory Notice | |

| Notice Type Guidance |

Referenced Rules & Notices NASD Rule 3160 Regulation T §§ 220.4 and 220.8 SEC Rule 15c3-3 NTM 06-62 |

| Suggested Routing Compliance Institutional Legal Operations Registered Representatives Senior Management Systems |

Key Topic(s) Extension Processing |

Executive Summary

FINRA has integrated the legacy NYSE Regulation and NASD extension of time processing systems into one combined system. Effective November 17, 2008, all requests for an extension of time must be filed through the new system, known as the "Reg T" system, which is accessible through FINRA's Firm Gateway.

Through FINRA's Reg T system, firms will have the ability to submit extension of time requests by completing an online request form, uploading a file via the File Upload page on the system, or transmitting a file via a batch processing feed using File Transfer Protocol (FTP). In addition, clearing firm members must submit their monthly reporting of correspondent firms' extensions to transactions ratio by completing an online form accessible via the FINRA Firm Gateway. Upon completion of the integration, the legacy NYSE Regulation filing platforms and the batch file submission processed through the Securities Industry Automation Corporation (SIAC) will be eliminated.

This Notice also details new data field requirements for the Reg T system.

Questions concerning this Notice should be directed to:

Background & Discussion

Regulation T, issued by the Federal Reserve Board (FRB) pursuant to the Securities Exchange Act of 1934 (Exchange Act), governs, among other things, the extension of credit by broker-dealers to customers to pay for the purchase of securities.1 SEC Rule 15c3-3 requires, among other things, broker-dealers to promptly obtain and maintain physical possession or control of customer securities and designates periods of time within which broker-dealers must satisfy any deficiency (including those that arise from a customer "long" sale for which the customer has not delivered the securities within the requisite time period) by buying-in or otherwise obtaining possession or control of the securities.2

Under SEC Rule 15c3-3(n), a self-regulatory organization (SRO) may extend certain specified periods to buy-in a security, for one or more limited periods commensurate with the circumstances, where the SRO: (1) is satisfied that the broker-dealer is acting in good faith in making the request; and (2) exceptional circumstances warrant such action.3 Regulation T has a similar standard to allow an extension of time for payment for purchase of securities.4

Pursuant to NASD Rule 3160, all clearing member firms for which FINRA is the designated examining authority (DEA) must submit requests for extension of time under Regulation T or SEC Rule 15c3-3(n) to FINRA. Since the SRO designated as a firm's DEA has responsibility for examining its members' compliance with applicable financial responsibility rules such as Regulation T and SEC Rule 15c3-3, requiring a firm to submit extension requests to its DEA helps to ensure that the DEA receives complete extension information to assist it in performing this regulatory function. As further detailed below, each clearing firm member for which FINRA is the DEA also must file a monthly report with FINRA indicating all broker-dealers for which it clears that exceed a given ratio of requested extensions of time to total transactions.

Personnel preparing extensions of time requests are expected to obtain supporting documentation authorizing or requesting them to apply for an extension of time on behalf of a customer. Firms are reminded that a customer is not entitled to an extension of time. As noted above, extensions of time may only be requested in exceptional circumstances, and firms are responsible for determining the appropriateness of requesting any such extension.

Integration of Extension Processing Systems

Consolidation of FINRA's extension of time processing protocols and related technology is part of the integration of NASD and the member firm regulation operations of NYSE Regulation. Historically, firms requested extensions of time through (1) FINRA's current Reg T system (available via the Firm Gateway and Regulation Filing Applications (RFA) system), (2) NYSE's eMEX system (via the Electronic Filing Platform (EFP)), or (3) SIAC. The new integrated approach will allow FINRA to more efficiently process, monitor and service firms that request extensions of time on transactions. Firms that requested "Firm to Firm" extensions via the NYSE's EFP system will now be able to request such extensions using the same interface, within the Reg T system, as that used for customer extensions. As of November 17, 2008, all requests for an extension of time must be filed through FINRA's Reg T system. As discussed below, firms will have the ability to request extensions of time directly through the Web site by completing an online request form, uploading a file on the Web site, or transmitting a file via a batch processing feed using FTP.

Firms that use a service bureau to submit extension requests on their behalf through SIAC must ensure that this Regulatory Notice is promptly communicated to their service bureaus so that any programming changes are effective by November 17, 2008.

Expanded File Format/Layout and Data Elements

The batch file formats that are currently used for FINRA's existing system and the NYSE's EFP application have been expanded and some new data requirements have been added to the new format and file layout. These same data fields will also be required from members that file via FTP. The following is a list of the new and/or expanded data elements:

The new file format for all of the data elements can be found in Attachment A to this Notice. The additional data collected by FINRA will enhance its member surveillance and examination capabilities. The file format indicates all of the data elements that will be required, regardless of whether a firm submits extension of time requests via the Web site using the upload process or via FTP batch submissions. If a firm transmits an extension file using the old format, the transmission will be rejected. Members that currently file extension of time requests via the NYSE EFP system or SIAC will need to make changes to the file format to provide the new information outlined in Attachment A. In particular, FINRA notes that failure to provide the required CRD numbers will result in denied extensions. Therefore, it is important that both carrying and clearing and correspondent broker-dealers ensure that they obtain the appropriate CRD numbers that will be required when submitting extension of time requests.

Monthly Reporting Requirement Regarding Correspondent Firm Extensions

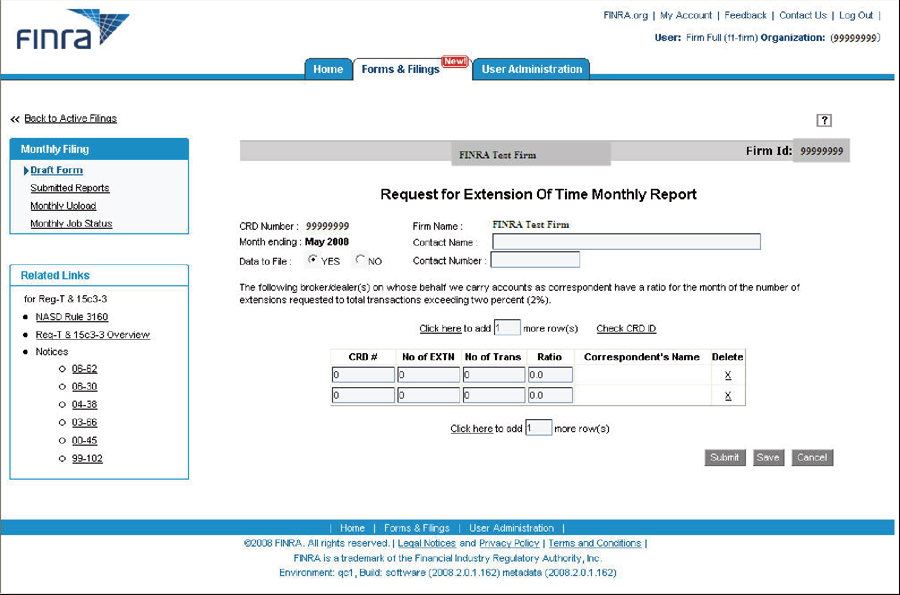

NASD Rule 3160(b) requires each clearing firm member for which FINRA is the DEA to file a monthly report with FINRA indicating all broker-dealers for which it clears (i.e. correspondent firms) that have overall ratios of requests for extensions of time as noted by Regulation T and SEC Rule 15c3-3 to total transactions for the month that exceed 2 percent.5 A template within the Reg T application permits clearing firms to submit the required reports regarding their correspondent firms' extension requests. The template is set forth in Attachment B of this Notice. The monthly report will require clearing firms to identify, among other things:

Firms must submit the monthly report directly through the FINRA Web site no later than five business days following the end of the preceding calendar month.6 For months when no correspondent broker-dealer for which it clears exceeds the criteria, the clearing firm should submit a report indicating such.7

FINRA will monitor the number of Regulation T and SEC Rule 15c3-3 extension requests for each firm to determine whether to impose prohibitions on further extensions of time. As further detailed below, FINRA will prohibit further extensions of time for correspondent firms that exceed a 3 percent ratio of the number of extension requests to total transactions for the month (notwithstanding the fact that the monthly report described above identifies correspondent firms that have ratios of extensions of time requests to total transactions exceeding 2 percent for the month).8 In addition, FINRA will prohibit further extensions of time for clearing firms that exceed a 1 percent ratio of extensions requested to transactions.9

More specifically, to the extent that firms exceed the applicable threshold limits (1 percent for clearing firms and 3 percent for correspondent firms), FINRA will inform them that their ability to receive extensions for their customers will be stopped for a 90-day period if the firm does not reduce the number of subsequent requests below the applicable limit by the next reporting period.10 FINRA believes that these limits are appropriate in light of the standard set forth in Regulation T and SEC Rule 15c3-3 that extensions of time may only be granted under "exceptional circumstances." While FINRA does not at this time contemplate any changes to the thresholds referenced herein, any future changes to these parameters will be published in a subsequent Regulatory Notice.

Reports

Firms will have access, via the same Reg T system, to online extension reports that will include information based on all of the submitted data elements. Firms will be able to query for extensions that are granted, denied and/or rejected, as well as accounts that have been "finalized."11 Firms submitting batch files via FTP batch upload will be able to access a copy of the extension report electronically.

Testing

FINRA understands that the integration of the extension processing systems will require firms to make modifications to their systems. FINRA will make the Reg T Customer Test Environment (CTE) available for firms to test their programming changes beginning late October or early November 2008 at https://regfilingtest.finra.org. For firms that will transmit files via FTP, FINRA will accept test data files transmitted through its testing environment during this same time period. Please refer to the Message Center, https://regfiling.finra.org, for further information about testing. For firms that are not familiar with the Reg T system and FTP submission process, a fact sheet outlining the process is available at www.finra.org/web/groups/reg_systems/documents/regulatory_systems/p038475.pdf. Users will need a FINRA user ID and password to access CTE. Firms that encounter technical problems, or need to request a FINRA user ID and password, should contact the FINRA Help Desk at (800) 321-6273.

Training

FINRA recognizes that firms may need additional support with the changes addressed in this Notice, and intends to make any necessary training available. FINRA will issue a further notification as such training becomes available.

1 12 CFR 220.4(c) and 220.8(d). Regulation T provides that a customer has one payment period (currently five business days) to submit payment for purchases of securities in a cash account or in a margin account.

2 17 CFR 240.15c3-3.

3See SEC Rule 15c3-3(n), authorizing SROs to extend the periods of time to buy-in a security specified in SEC Rules 15c3-3(d)(2), (d)(3), (h) and (m).

4 Under Regulation T, a firm's examining authority may grant an extension unless the examining authority believes that the broker-dealer is not acting in good faith or that the broker-dealer has not sufficiently determined that exceptional circumstances warrant such action. See Regulation T §§ 220.4(c) and 220.8(d).

5See NASD Notice to Members 06-62. Self-clearing firms that do not clear for other firms are not required to file these reports because such firms do not have any correspondent broker extension information to provide to FINRA.

6See NASD Rule 3160(b).

7 FINRA's system has the functionality to permit a clearing firm to submit a "non-applicable" report for any months in which none of the firm's correspondents exceed the 2 percent ratio. FINRA encourages clearing firms to submit such report, as appropriate, so it is clear to FINRA staff that the firm did not neglect to file a required report.

8 The 2 percent threshold provides FINRA with an "early warning" notice as to the concentrations of extension requests for correspondent firms. FINRA will use the information submitted by the clearing firms in the NASD Rule 3160(b) monthly report to monitor correspondent firms' compliance with the 3 percent threshold.

9 FINRA will calculate the 1 percent ratio using the number of extensions requested pursuant to Regulation T and SEC Rule 15c3-3 to transactions as reported by the clearing firm on field 4980 of the FOCUS II Report.

10 For example, if a correspondent firm exceeds the applicable threshold for the month of July 2008, its clearing firm would report that fact to FINRA by August 7, 2008 (i.e., five business days after the end of the month). FINRA would advise the correspondent firm that it had exceeded its threshold and that it must reduce the number of subsequent requests below the limit by the end of August 2008. If the correspondent firm exceeds the applicable threshold for the month of August 2008, its clearing firm would report that fact to FINRA by September 8, 2008 (i.e., five business days after the end of the month) and the 90-day suspension would start at that time.

11 The term "finalized" refers to individual customers who have reached their allowable limit of extensions; i.e., the customer has received five Regulation T extensions or nine SEC Rule 15c3-3 extensions in the preceding 12 months.

Attachment A

FINRA Reg T/15c3 Upload Format

The FINRA REGT record format uses three types of records. There should be only one Header and a Trailer Record for each REGT Filing. A Detail Record is used to report each REGT and/or 15C3 extension request.

NOTE: If a firm or service provider submits multiple filings in a single file, and any of the filings are rejected, the status of the job will show as Rejected (even if four out of five filings are accepted). It is the submitter's responsibility to make sure that all filings are submitted correctly.

Header Record

A Header record must always be the first record of each filing submitted to FINRA. Firms must populate the third field in Header Record with "REGT." All fields are required.

| Field | Type | Positions | Format | R/O | Description |

| Record Type | Char (1) | 1 | "H" | R | "H" Identifies this as a Header Record. |

| Firm CRD# | Integer (8) | 2–9 | R | Firm CRD Number of the firm requesting the extensions that follows. | |

| File Identifier | Char (4) | 10–13 | "REGT" | R | Identifies the file as a REGT file. |

Detail Record

One Detail Record is required for each extension request being made by the firm identified in the preceding Header Record. There must be at least one Detail Record for each Header Record in the file.

Layout for REGT and 15C3 Extension Requests

NOTE: When filing a secondary (or subsequent) request (Multi Request Count > 1), all data fields in the table below MUST match the value supplied in the original request except those fields marked with an asterisk (*) following the name, or the request shall NOT be GRANTED. In the case of CUSIP/Issue Symbol (**), as long as the value supplied maps to the same security, either can be provided on a subsequent request.

Keys to reading this chart: R/O stands for Required (R) or Optional (O).

| Name | Type | Pos | Format | Reg-T R/O | 15C3 R/O | Description |

| Record Type | Char (1) | 1 | "D" | R | R | "D" identifies this as an Extension Request Detail Record. |

| Request Type | Char (4) | 2–5 | "REGT" or "15C3" | R | R | Must have the value "REGT" or "15C3." |

| Request Date | Date | 6–13 | yyyymmdd | R | R | Must equal the current system date. Request Date should be the date of submission. (NOTE: For secondary extensions, this must be the original Request Date.) |

| Multi Request Count* | Number (1) | 14 | 1 | R | R | Counts extension iteration number. The original is 1, a second extension request is 2, a third request is 3, etc. |

| Reason Code* | Number (3) | 15–17 | R | R | Right-justified, zero filled (01 should be 001). | |

| Requested Days* | Number (2) | 18–19 | R | R | Any request submitted with a value greater than the maximum number of days allowed for the Reason Code supplied will be denied. | |

| Issue Symbol** | Char (14) | 20–33 | O | O | Required to have either Symbol or CUSIP. | |

| CUSIP** | Char (16) | 34–49 | O | O | Required to have either Symbol or CUSIP. | |

| Quantity | Number (12) | 50–61 | R | R | Enter the quantity associated with the CUSIP or Issue Symbol selected above. | |

| Amount* | Number (14) | 62–75 | R | R | Enter the total dollar amount of credit extended to this account for the specified trade date. If this total amount due is $1,000 or less, no extension request(s) need be made. For secondary extension requests the total dollar amount must not exceed the value on the original request. |

Char fields must be left justified and space-filled. Number fields must be right justified and zero-filled.

Keys to reading this chart: R/O stands for Required (R) or Optional (O).

| Name | Type | Pos | Format | Reg-T R/O | 15C3 R/O | Description |

| Trade Date | Date | 76–83 | yyyymmdd | R | R | |

| Settlement Date | Date | 84–91 | yyyymmdd | R | R | |

| Account Type | Char (1) | 92 | C/M | R | N/A | Cash (C) or Margin (M) |

| New Issue Flag | Char (1) | 93 | Y/N | R | N/A | If it is a New issue, the Request date should be 5 days from Settlement date |

| Registered Rep CRD# | Number (12) | 94–105 | R | O | Required for 15C3 Rule Type M. | |

| Branch CRD# | Number (10) | 106–115 | R | O | Required for 15C3 Rule Type M. | |

| Correspondent Firm Flag | Char (1) | 116 | Y/N | R | O | Required for 15C3 Rule Type M. |

| Correspondent Firm CRD# | Number (8) | 117–124 | O | O | Required if Correspondent Firm Flag is "Y." Required for 15C3 Rule Type M. | |

| Correspondent Branch CRD# | Number (10) | 125–134 | O | O | Required if Correspondent Firm Flag is "Y." Required for 15C3 Rule Type M. | |

| Customer Type | Char (1) | 135 | R | O | In 15c3-3 Forms, the Customer Info data is optional for Rule Type codes of D2, D3, and H. The Customer Info section is required with Rule Type of M. Valid Values are: S—Domestic Individual T—Domestic Company P—Foreign Individual I—Foreign Company |

|

| SSN / TIN | Number (9) | 136–144 | O | O | Required if Customer Type is "S" or "T." SSN number for Domestic Individual (S). TIN for Domestic Company (T). For Customer Types Required for 15C3 Rule Type M. | |

| Account Number | Char (30) | 145–174 | R | O | Customer Account Number. Acts as Unique Customer Identifier for Foreign Customer Required for 15C3 Rule Type M. |

Keys to reading this chart: R/O stands for Required (R) or Optional (O).

| Name | Type | Pos | Format | Reg-T R/O | 15C3 R/O | Description |

| Company Name | Char (36) | 175–210 | O | O | Required if Customer Type is Domestic Company (T) or Foreign Company (I). Required for 15C3 Rule Type M. | |

| Last Name | Char (25) | 211–235 | O | O | Required only if Customer Type is Domestic individual (S) or Foreign Individual (P). Required for 15C3 Rule Type M. | |

| First Name | Char (25) | 236–260 | O | O | Required only if Customer Type is Domestic individual (S) or Foreign Individual (P). Required for 15C3 Rule Type M. | |

| Middle Initial | Char (1) | 261 | O | O | Optional only if Customer Type is Domestic individual (S) or Foreign Individual (P), otherwise leave blank. Optional for 15C3 Rule Type M. | |

| Rule Type | Char (2) | 262–263 | N/A | R | Select a SEC rule type from the list. Available rule types are D2, D3, H and M. | |

| Deficiency Date | Date | 264–271 | yyyymmdd | N/A | O | Enter the date on which the firm discovered the deficiency. Required for Rule Type D2 or D3. The Deficiency Date must be 1 or 2 business days prior to the request date. |

| Payable Date | Date | 272–279 | yyyymmdd | N/A | O | Enter the date on which dividends are to be paid. Payable date is required if the rule type selected is D3. |

| Contra Broker Dealer CRD# | Number (8) | 280–287 | N/A | O | If the rule type is D2, enter the CRD ID of the broker-dealer failing to deliver the securities. | |

| Receivable From | Char (50) | 288–337 | N/A | O | If the rule type is D3, enter the name of the party from whom the dividend, stock split, etc., is due. |

Trailer Record

A Trailer Record is required for each filing (even if there is only one filing) in a file.

| Field | Name | Type | Positions | R/O | Format | Description |

| 1. | Record Type | Char (1) | 1 | R | "T" | "T" identifies this as a Trailer Record. |

| 2. | Total Records | Number (5) | 3–7 | R | Total number of records in the filing, including the header record, but excluding the trailer record. This should be right justified. |

Attachment B